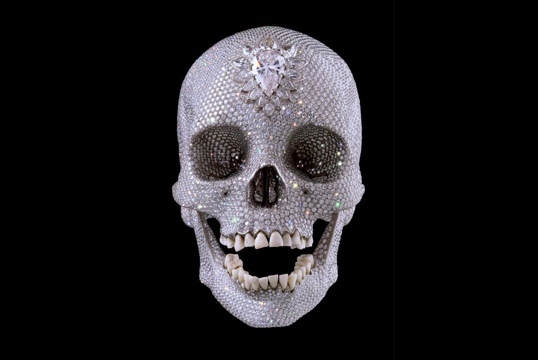

photo of Damien Hirst’s Diamond skull on display at the White Cube gallery in London. EPA/WHITE CUBE.

The Map and the Territory, the latest novel by the mordant French satirist Michel Houellebecq, opens with a description of a painting titled Damien Hirst and Jeff Koons Dividing Up the Art Market. Koons is portrayed throwing his arms wide. Hirst is slumped on a white leather sofa, drinking a beer. For Houllebecq’s fictional artist, “Hirst was basically easy to capture: you could make him brutal, cynical in an ‘I shit on you from the top of my pile of cash’ kind of way; you could also make him a rebel artist (but rich all the same) pursuing an anguished work on death; finally, there was in his face, something ruddy and heavy, typically English, which made him look like a rank-and-file Arsenal supporter.”

Hirst is not only the world’s richest artist, but a transformative figure who can be assured of his place in history. Sadly – for him and for us – this is not because of the quality of his work but because he has almost single-handedly remade the global art market in his image: that is to say, the image of the artist as celebrity clown, the licensed working-class fool who not only shits on us from on top of his pile of cash, but persuades us to buy that shit and beg for more. This cockney chancer routine, perfected in the 60s by the likes of David Bailey and Keith Moon, has deep roots in British pop culture. We have a lot of affection for guys like these, who seem to be getting away with it, sticking it to the man.

In the early 90s, Hirst seemed like a breath of fresh air, a rave-era blast against the terrible, starchy politeness that characterised the British art scene. In a world of high theory and rigorously monochrome wardrobes, it was funny to say that you paid assistants to make your art “because I couldn’t be fucking arsed doing it”. Then, when stories of your millions were all over the press, and it came out that those assistants were extremely poorly paid, it seemed less funny. Now, in Hirst’s current incarnation as house artist to the 1%, running some kind of Foxconn-style production line on his compound in Baja California, the cheeky chappie act has lost its last residue of charm.

This year may come to be seen as the high-water mark of Hirst’s cultural power. On 4 April, a retrospective of his work opens at Tate Modern in London. In January, an exhibition of his “pharmaceutical paintings”, canvases of varying sizes covered in uniform coloured dots, opened in all the Gagosian Gallery’s 11 locations around the world. These are major shows, intended to underscore the status of an artist who, at least in the UK, seems to need no help in reaching an audience. The most interesting thing about them is the hints they drop about the new rules of the art world, and about the artist’s future reputation, which is not as secure as it might appear.

As Hirst has become wealthier, his work, which (as Houellebecq points out) incessantly circles the twin poles of death and money, has lost the cocoon of edgy cool that sheltered it through the 90s, to emerge, like one of his murdered butterflies, in its full form: as a pure commodity, fluttering free of the things that tie most art down – aesthetics, geography, the specifics of material and manufacture. He has certain signature elements (dots, pills, dead things, shiny shelves, chunks of scientific text) that can be deployed, with minor variations, at every price point from major installation to souvenir mug. His thematic interests in pop culture, shock and replication make it easy to keep a straight face while he sells his dodgier diffusion lines in markets that haven’t been saturated by the earlier “better” work – see, for example, the shameless recent series of National Geographic-style butterfly photos, punted out in Hong Kong, safely away from the derision that might have accompanied them in London or New York.

This isn’t just art that exists in the market, or is “about” the market. This is art that is the market – a series of gestures that are made wholly or primarily to capture and embody financial value, and only secondarily have any other function or virtue. Hirst has gone way beyond Warhol’s explorations of repetition and banality. Sooner or later, his advisers will surely find a way for him to dispense with the actual objects altogether and he will package concepts in tranches, like mortgage securities, some good stuff with some trash, to be traded on the bourse in Miami-Basel.

For the moment, Hirst still has to make things and we still have to look at them. The byproduct of his activities is the most starkly authoritarian corpus of art of recent times. All those hard, glittering surfaces, those rotting animals. The body, for Hirst, is trash, which exists to be anatomised, displayed, described in cribbed Latin names. The only way to cheat death is to slough off your rotting flesh and take on the qualities of capital. It’s the 21st-century version of ars longa, vita brevis. Don’t just make money, be money: weightless, ubiquitous, infinitely circulating, immortal.

The aspiration to break the bounds of the particular has always shown through in such Hirst titles as I Want to Spend the Rest of My Life, Everywhere, With Everyone, One to One, Always, Forever, Now (his 1997 book) and Beautiful Inside My Head Forever, the 2008 Sotheby’s auction where he sold 8m worth of art direct to the public, bypassing the galleries who represent him.

This drive to disembodied ubiquity is a message to the proles, to awe us, crush us, sap our will to resist. We, after all, are stuck in our stubbornly physical bodies, which we need to feed and clothe and shelter under conditions of ever-greater austerity and social discipline. We are faced with an enemy that seems impossible to kill. In For the Love of God, the grinning, diamond-encrusted skull that formed the centrepiece of Hirst’s last London show before the 2008 crash, we behold the face of our masters. And in its failure to sell for its 0m asking price, we can detect signs of the invisible hand moving against the skull’s Barnumesque creator. The world’s most expensive contemporary artwork was eventually bought by a consortium that included the artist himself and his London gallery, White Cube. It was, in an important sense, a work that would not have been complete without a buyer, and its failure to sell would have been damaging to Hirst’s prices, which in art, as in any other asset class, are highly dependent on investor confidence.

Investor confidence is the key to understanding the unprecedented Gagosian show of Hirst’s spot paintings. Hirst’s atelier has been turning these out at every scale since 1986, and by the artist’s own estimate there are around 1,400 in existence, of which Gagosian was showing 300 under the faux-definitive title The Complete Spot Paintings. They are made by Hirst’s assistants to a simple aesthetic rule – the colour sequences of the dots must be “random”. The paintings are given the names of drugs: Amphotericin B, Cocaine Hydrochloride, Morphine Sulphate, Butulinium Toxin A, and so on. Many of them are technically difficult to execute, such as the piece completed for the Gagosian show that comprises 25,781 one millimetre spots that the poor bloody assistants had to paint without repeating any single colour. Examples have sold at recent auctions for between 0,000 and m. This is to say that they are valued like unique, individual works of art, yet are made in quantities – and using methods – that seem to deny this fiction. Thus one could make the case that they are significantly overvalued. Cue alarm in a lot of penthouse living rooms.

If I were Larry Gagosian (usually cited in power lists as the contemporary art world’s most important player) and I wanted to help my top client shore up the value of a body of work that was losing its lustre as its fashionable 90s aesthetic began to look tired, and the penny started to drop among collectors that at every other dinner party they went to they saw something on the wall that looked awfully similar to the something on their own wall, what would I do?

Long-term value in the art world depends in a certain raw way on scarcity, but is largely produced through a delicate process by which aesthetic value (determined by curators and critics) intersects with market value, determined ultimately by auction prices. One point at which these two types of value intersect is in provenance. The story behind an object – its past owners, where it has been shown, its place in the story of the artist’s career, and so on – confers both types of value. A landmark show, geographically dispersed in an unprecedented way, is bound to be remembered as a significant moment in Hirst’s career as a global art star. When that show is accompanied by a critical apparatus, chiefly a catalogue raisonnée (a meticulously documented list of works shown, accompanied by scholarly essays), those works become part of a canon and a magical walled garden of significance is erected around them.

As Francis Outred, Christie’s European head of contemporary art, told the Economist, this catalogue “could bring reassuring clarity to the question of volume”. The pharmaceutical paintings are frankly too financially valuable to too many people for their actual status (banal, mass-produced, decorative) to intrude on the consensus fiction that they are scarce and important. The owners of the 1,100 paintings not in the Gagosian show should be nervous, though. They just lost their AAA rating.

Like any major artist, Hirst is not the only person to have a stake in his success. Gallerists, museums and auction houses have investments, reputations and income streams to protect. The people with the greatest interest in maintaining Hirst’s prices are the collectors who have already invested in his work. These collectors include some of the world’s most sophisticated speculators: The Physical Impossibility of Death in the Mind of Someone Living, the tiger shark in a tank that became the icon of 90s Britart, is, for example, now owned by the hedge fund billionaire Steven Cohen, the founder of SAC Capital Advisers, who has bn under management.

This is how it works. A few major collectors make the market. Where they lead, the horde of hedgies follows. Many of the new breed of art investors (not Cohen, who is known to be a man of great taste and exquisite legal representation) have jettisoned even the pretence of connoisseurship. Some of these guys care about the bragging rights that come with a blue-chip work hanging in the loft. Others are all about the numbers, and employ the same tools and decision-making processes to play the art market that they use at work. A few have also discovered that many of the regulatory mechanisms that apply in other markets – preventing insider trading, price-fixing by cartels and sundry other abuses – simply don’t exist in the art world. It is possible to game the system in many ways, and the careers of certain artists look not unlike a classical Ponzi scheme, where money from new investors is used to pay returns to those further upstream.

Will every collector who bought multimillion-dollar vitrines from Beautiful Inside My Head Forever see their works increase in value? Or will that value just accrue to the early-90s works on which Hirst’s reputation rests, works held by the market-makers? How about those spot silkscreens, priced attractively at a few thousand pounds but produced in editions of a thousand or more? Do they have a future as anything more than wallpaper? It’s certain that pieces such as the shark, which have a place in the story of 90s British art, will retain their value – even if it’s not exactly the same shark, the original having rotted and been replaced in 2006. But with such a glut of Hirst out there, there’s no doubt that some people are going to lose their shirts.

In this context, art museums find themselves in the eye of a storm. Nothing confers more value on an artwork than its selection for inclusion in a museum show. It is the definitive critical vote of confidence. This, of course, depends on the fiction that such decisions are made on pure, aesthetically disinterested grounds. As sophisticated investors enter the market and work out how the game is played, that particular story is wearing thin. This is not to say that the Tate shouldn’t be showing Hirst. Its director, Nicholas Serota, attended Freeze, the 1988 student show that first brought the artist to public attention, and the Tate has consistently supported the “YBA” generation of which he is a part, helping to shape the explosion of interest in British contemporary art, not just among speculators but an art-loving public who pay entrance fees and buy nothing more expensive than a postcard.

However, Serota, like other museum directors, is expected to find money to run his institution from a variety of sources, including corporations and private individuals, and this makes museums vulnerable to pressure from those who wish to use them to confer value on their holdings. For many years, the Tate had a sponsorship relationship with UBS. One of the benefits received by the Swiss bank were regular Tate shows of works from its collection. Other major corporate collectors routinely negotiate similar deals. Deutsche Bank has relationships with institutions such as the Whitney and Guggenheim, unself-consciously declaring, in a press release accompanying a recent Georg Baselitz show in Italy, that the artist’s work “constitutes an important part of the Deutsche Bank collection. Deutsche Bank acquired significant works by the artist as early as 1981 … In 1999, Deutsche Bank honoured him with the show Nostalgia in Istanbul at the Deutsche Guggenheim …”

The corruption of art museums by investors is perhaps most apparent in the case of New York’s New Museum. In 2009 it devoted its entire three-floor space to an exhibition of the collection of Dakis Joannou, a Greek Cypriot industrialist who sits on the museum’s board. Other recent New Museum shows, devoted to Urs Fischer and Elizabeth Peyton, also relied heavily on Joannou’s collection, and his wider web of patronage. The impression has been given of a museum that is no longer able to make independent determinations of value. This has become an open scandal in New York, satirised in a much-reproduced drawing by William Powhida titled How the New Museum Committed Suicide With Banality, or “how to use a non-profit museum to elevate your social status and raise market values”. Likewise, Hirst’s major collectors will see an effective windfall from the inclusion of their works in a Tate retrospective, and other Hirst stakeholders will benefit too. That may not be why the show is happening, but it is not without significance.

Despite the financial crisis, contemporary art continues to soar in value. The unprecedented concentration of capital in the hands of the global elite means that the art market, being essentially a very high-end service industry aimed at generating a pleasurable experience of differential consumption, is weathering the storm very nicely. The Mei Moses index, a measure that largely relies on sales of paintings in London and New York, outperformed the S&P500 by nine points in 2011. New York magazine recently printed graphs (drawn on data from Artnet) that show Hirst’s work outperforming contemporary art in general.

Other figures suggest the picture for Hirst is less rosy. In 2008, the year of Beautiful Inside My Head Forever, just over 0m-worth of his art was sold at auction, a world record for a living artist. His 2009 sales were 93% lower. Capital needs to be put to work, and a double-digit rate of return looks excellent in any economy. For the moment, Hirst’s work is still an attractive investment, but market sentiment may move against him. The artist himself is undaunted. He recently announced that he has enlisted two assistants to paint 2m tiny spots on a canvas. He estimates that it will take them nine years to complete.

guardian.co.uk © Guardian News & Media Limited 2010

Published via the Guardian News Feed plugin for WordPress.